The content of the 2021 annual board of directors’ management review is as follows:

I. Discussion and analysis of operating conditions

In the first half of 2021, the backlog of household consumption demand affected by the epidemic was gradually released, and the company’s various operating data were quickly repaired; since the second half of the year, real estate-related regulatory measures have been introduced one after another, and consumers’ willingness to buy houses has been affected to a certain extent in the short term.

However, no matter how the general trend changes, consumers’ pursuit and yearning for a better life have not undergone fundamental changes, and the basic needs of "decorating a personalized home" have not undergone fundamental changes. Therefore, the company insists on continuously meeting the needs of consumers as its mission. Through measures such as reaching customers through omni-channel, creating high-value, efficient products and extreme scene experiences, optimizing professional case design and one-stop matching, it has continuously tackled difficulties in the unfavorable environment of intensified competition and sharp fluctuations in raw material prices.

During the reporting period, the operating income was 20.442 billion yuan, an increase of 38.68% year-on-year, and the net profit attributable to shareholders of listed companies was 2.666 billion yuan, an increase of 29.23% year-on-year.

2021 is the first year for the company to launch the long-term development goal of "turning Europai into a world-class home furnishing group". The three major systems of marketing, function and manufacturing are fully coordinated, and they have taken a solid first step.

(I) Functional system

During the reporting period, adhering to the tenet of business promotion, service and guarantee, the functional system is based on the medium and long-term incentive mechanism, and promotes the dynamic control of salary and preparation; continuously improves the efficiency of capital use, operation accounting efficiency, financial settlement efficiency and quality; in extreme environments, multiple means to ensure the supply of raw materials, and multiple measures to implement procurement control costs; strengthen the system governance and supervision and verification functions, firmly adhere to the bottom line of compliance, and consolidate risk control; the digital construction of internal affairs has achieved obvious results, and the logistics support work has been further transformed and upgraded.

(2) Manufacturing system

In 2021, due to repeated epidemics, logistics interruptions, raw material price increases, superimposed environmental protection production restrictions, power cuts and many other unfavorable factors, the manufacturing system through the effective implementation of lean improvement, intelligent manufacturing, information construction, incentive mechanism reform and innovation, greatly improve the production efficiency, significantly reduce the comprehensive cost rate of manufacturing, meet the customer’s increasingly stringent requirements for product quality, price, delivery and service, providing a strong guarantee for the realization of the company’s business goals.

1. During the reporting period, the company’s wardrobe net aldehyde upgrade, integrated research and development, cabinet door branch production, door panel new product development and promotion and other key projects achieved remarkable results; wooden door lean production model reform and engineering system special project construction achieved phased results; cabinet standardization and other projects achieved initial results;

2. The improvement of the operation of each production base has achieved remarkable results. During the reporting period, a total of nearly 200 lean improvement projects were carried out. At the same time, the Group was escorted by means of fine control and operation standardization to reduce costs and increase efficiency.

During the reporting period, the company completed more than 400 types of new Product Research & Development in 2022; the company’s R & D center was awarded the National Industrial Design Center; the product won a number of German Red Dot Awards, Japan G-MARK Design Award and other international design awards; the home product system was fully upgraded, greatly integrated, streamlined and optimized; the pre-research technology development results were excellent, and the cost was effectively reduced by more than 10 million; the performance growth momentum of smart home related products is gratifying.

4. The procurement informatization has achieved remarkable results: the coverage rate has risen to 98%, and the "iron triangle" function of the three-level coordinated procurement system of groups, business lines, and bases has begun to show results.

(III) Marketing system

1. The Oupai wardrobe (customized for the whole house) is imposing like a rainbow, and the peak is determined in Kunlun

In 2021, Oupai Wardrobe (Whole House Customization) will cut through the thorns all the way with the "trend of the king" and attack the city. First, in order to meet the urgent demands of consumers for environmentally friendly home furnishings, from a single substrate without aldehyde to space net aldehyde, break the situation with "net aldehyde" and lead a new round of "environmental protection wave" in the industry; second, profound innovation and change, from layout display to event landing, marketing model innovation to bag carrying, e-commerce, home improvement, and complete decoration channel expansion, all-round attack, and comprehensive customer acquisition; third, breakthrough to lead the whole customization, extending cabinet customization to space customization, leading the industry with "three high" (R & D, appearance, strict) standards, injecting new momentum into the company’s future development.

2. Oupai cabinets are strong and empowered

In 2021, the core competitive advantages of Oupai cabinets will become more solid and prominent. First, more than 1,300 new and newly installed stores will be opened throughout the year; more than 3,000 retail dealers will be promoted to cooperate with the installation enterprises; more than 600 stores will be opened throughout the year through innovative integrated kitchen business models; second, the multi-point layout of complete decoration, distribution, and integrated kitchens will build channel advantages and lead the development direction of all channels; third, we will grasp the pulse of the market, create new marketing models such as "healthy kitchen" and "old kitchen rejuvenation", and fully inject new momentum into business development, fully reflecting the strength and appeal of the world’s leading cabinet brands.

3. The whole house is equipped to ride the wind and waves and make great progress

2021 is the fourth year that the home furnishing industry is leading the way, and it is also the year of "breaking the game" for the European home furnishing industry. The annual order performance has increased by more than 90% year-on-year, achieving high-speed growth. The first is to launch a new brand "StarHomes Star Home", realize the integration of dual brands into the entire customized track, and consolidate and further expand the company’s leading advantage in the complete track under the strategic policy of "two wings go hand in hand, global coordination"; the second is to take customized products as the core + resource integration + double dragon alliance form of continuous evolution, give full play to the unique advantages of European products, effectively fill the product shortcomings of home improvement companies, and further strengthen the empowerment of end points; the third is to carry out a full range of "blood transfusion" and "wisdom transfer" for large home furnishing dealers to help the reconstruction of the end point operation system, the transformation of the management model and the improvement of the overall operation efficiency.

4. Actively respond to large-scale businesses and seek progress while maintaining stability

In 2021, Oupai’s bulk business will actively adjust its business rhythm in response to market changes, strictly control risks, and seek progress while maintaining stability. First, it will give full play to its multi-category R & D and manufacturing advantages, and cooperate with high-quality strategic customers to carry out a number of co-researched parts and supporting projects for accurate matching; second, it will give full play to the advantages of large home furnishings, fully penetrate the hardcover post-loading business, and transform from a hardcover material supplier to a hardcover whole service provider; third, it will deeply cultivate talent housing, affordable housing, and the reconstruction of old residential areas in various places, as well as national key supporting projects in Beijing, Xiongan New Area, Shenzhen, and other regions. Therefore, even in the context of severe competition in the real estate fine decoration supporting business, the company’s engineering business has hardly been affected by minefield projects, and has achieved steady growth

5. Obli transforms and moves forward, without stopping

Focusing on the strategic policy of Dare to "break through" and "create", Ou Boli has comprehensively upgraded its products, display and sales, achieved the promotion of the "whole house customization" industry, and successfully entered the first competitive echelon in the industry. The first is to carry out a new brand positioning of "specially born for the Me generation", and the target customers are more focused; the second is to reshape the original light luxury product system with "beauty", "quality", "material" and "interesting" as the core, and implement high, medium and low breakthroughs in the price belt to effectively expand the customer base; the third is to create a traditional retail upgrade + bag + packaging enterprise + e-commerce Obli channel ecological chain to realize the transformation to retail service providers, and maximize the passenger flow; the fourth is to expand the sales model from closet clothes to full-category full-house customization of "closet clothes, wood and bathroom + electrical appliances + home accessories" to achieve the transformation and upgrading of the end point profit model.

6. Opponi wooden doors are making multi-dimensional efforts, firmly ranking first in the domestic wooden door industry

In 2021, Ouponi wooden doors will make multi-dimensional efforts and achieve rapid growth in performance. First, brand building: around the five-defense function of the category, complete multiple rounds of new product launches through product + star dual IP blessing, and build a professional brand moat; second, channel deepening: the proportion of high-quality dealers throughout the year has been greatly increased, and home improvement cooperation channels have been deeply dug; third, model innovation: the M6 profit model has highlighted the effect, and the V3 sales design certification project has helped the customer order value to increase significantly. Throughout the year, a number of star tour live broadcasts and top-stream live streaming host live broadcasts have been completed, helping to receive more than 120,000 orders.

7. Oupai Sanitary Ware continues to lead the transformation of the bathroom industry

In 2021, Oupai Sanitary Ware, as the pioneer of Quanwei customization, will continue to lead the transformation of the bathroom industry, release Quanwei space health solutions, and strongly promote Quanwei customization into the 3.0 era. First, to create a new retail model of () integrated marketing communication; second, to complete the whole package, open up engineering channels, and successfully build a multi-channel business model; third, to establish a global strategic supply cooperation alliance to create a new marketing model of integrated bathroom space design, one-stop matching, and package services, and redefine the new standard of the industry.

(4) Digitization, informatization, and intelligence help "build Oupai into a world-class home furnishing group"

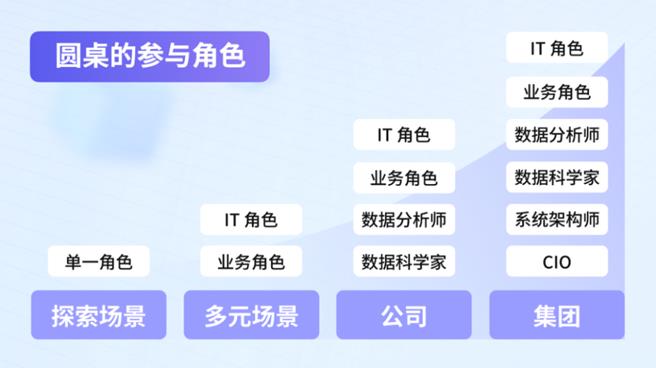

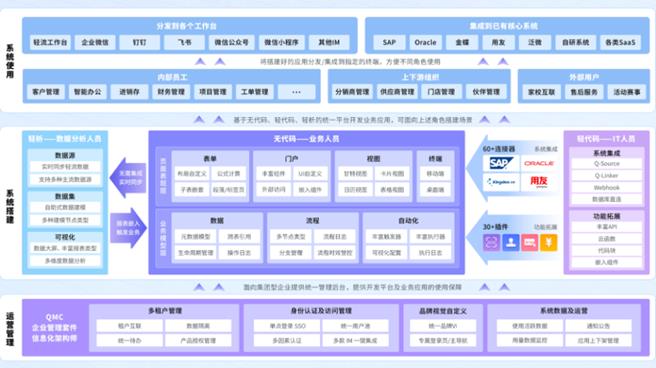

The information value chain of customized home furnishing is very long, and every link such as design, order placement, production, logistics, installation, and after-sales needs to be connected through information technology in order to provide users with a complete product customization experience. Focusing on the construction goal of "design and manufacturing integration, centralized planning, multi-base collaborative production, and intelligent manufacturing system support", the company has successfully built a large-scale non-standard customized home intelligent manufacturing support technology platform and an industrial Internet platform. It has built a full three-dimensional information model that supports the integration of large home furnishing design, display, and manufacturing. It has established a data center and a central product platform for marketing and manufacturing. Through the data intelligence center, it has realized the information management of the whole process from self-design to after-sales of customized products.

As a large-scale non-standard customization enterprise with an annual output of over 900,000 sets of cabinets and an annual output of over 2.90 million single wardrobes, the successful application of information technology has greatly improved the efficiency of the company in all aspects of design, quotation, order placement, order dismantling, technical review, price review and settlement, and correspondingly improved the efficiency of the entire chain.

1. Marketing informatization

During the reporting period, more than 7,000 stores across all categories and channels of the company have realized the full application of self-developed CAXA home design software. At present, CAXA home design software has realized the integrated design and scene sales of the whole house space (kitchen, clothing, wooden doors, wall panels, bathroom, balcony, home accessories). Intelligent technology applications such as intelligent design, one-click rendering, one-click process inspection, one-click quotation and one-click order placement not only make the design efficient and smooth and display realistic, but also ensure data quality, providing a strong guarantee for the integration of design, manufacturing and supply chain, and the digitalization of the whole business chain. In 2021, there were nearly 30,000 CAXA design software charging accounts, forming a cloud computing power support capability with more than 40,000 single-day online design solutions, more than 100,000 orders placed on peak days and more than 400,000 high definition rendering graph, which is the most cloud computing power for domestic customized enterprises.

2. Manufacturing informatization

The MSCS production scheduling control system and XMES flexible manufacturing management system independently developed by the company have reached more than 1 million pieces of board parts per day; fully realized the "75% trial-free, 85% trial-free and quick review, and 95% one-time pass" of customized orders; the settlement center and TIMS (delivery information system) platform completed the construction, comprehensively improving the efficiency of dealer capital settlement and order logistics warehousing and distribution management; innovating information models and software applications such as PLM, MPCS, and intelligent batch optimization, empowering manufacturing to reduce costs and increase efficiency; the order conversion capacity and level of such a large-scale non-standard customized home intelligent manufacturing support platform fully support the efficient operation of the world’s largest customized home enterprises.

3. Functional informatization

"Smart Park, Smart Office, Smart Manpower, Smart Process" The four-intelligence system has deepened the development and application, and entered a new stage of development of "Safe Europe + Smart Europe".

II. Industry situation of the company during the reporting period

(A) the basic situation of the industry

According to the National Economic Industry Classification issued by the National Bureau of Statistics in 2019 (GB/T4754-2017), the company is engaged in the wooden furniture manufacturing industry (C211) in the furniture manufacturing industry (C21); according to the "Guidelines for Industry Classification of Listed Companies (Revised in 2012) " issued by the China Securities Supervision Commission (Announcement of the Securities Supervision Commission [2012] No. 31), the company is engaged in the integrated innovation industry in the furniture manufacturing industry in the manufacturing industry – the overall home furnishing industry.

2. The industry in which the company is located is the furniture industry. Since 2018, with the changes in the real estate market and the adjustment of the channel structure, the overall growth of the furniture industry has been under pressure. The furniture industry has strong offline experiential consumption characteristics, and end point stores are important space display places and bear the functions of transaction links. Affected by the repeated impact of the COVID-19 pandemic in some regions and cities across the country, there are certain uncertainties in the operating environment and market conditions of furniture enterprises. End point retail channels are under pressure. Under the influence of epidemic prevention policies, furniture stores and end point outlets are temporarily closed, and installation service personnel cannot come to the door for delivery and installation, which in turn leads to the overall growth of furniture manufacturing revenue in the past two years under certain pressure. With the epidemic gradually under control, the backlog of consumer demand for some furniture was delayed, offline stores resumed normal business, and the retail market performance of the furniture industry gradually picked up. According to the statistics of the National Bureau of Statistics, the annual operating income of the furniture manufacturing industry was 800.46 billion yuan by the end of 2021, an increase of 16.42% compared with 2020.

3. The company’s subdivision is the custom furniture industry, and the specific categories can be divided into custom cabinets, custom wardrobes (whole house customization), custom wooden doors, custom bathroom cabinets, etc. With the improvement of consumers’ preference for personalized customized products, the improvement of the storage function demand for living space and the enhancement of the demand for unified overall style and "high value", the application field of customized furniture expands from kitchen space to bedroom, living room, balcony, bathroom, wall board and other spaces, and the penetration rate of subdivision categories also increases with the increase of consumer usage ratio. Customized furniture can better meet the composite needs of home improvement consumers for product function, appearance, and storage from the perspective of consumer demand. Mature custom cabinets, custom wardrobes in the growth stage (whole house customization), and other categories are each rejuvenated.

(2) Industry characteristics

1. Periodic

Custom furniture belongs to consumer discretionary, macroeconomic development cycle, real estate sales cycle, changes in national income and consumer consumption concepts, etc., will have a certain cyclical impact on the custom home industry.

2. Seasonality

Customized furniture industry has seasonal characteristics, mainly related to the purchase of commercial housing and the delivery time of commercial housing, and also related to the secondary decoration of residents’ old houses. At the same time, due to the vast territory of our country and the large climate differences, there is also a certain correlation between seasonality and geographical distribution.

3. Decentralization of layout

The overall market structure of the custom furniture industry is relatively fragmented. According to the data of brokerages and the industry, the CR5 is estimated to be about 15%. Although the market share of leading enterprises is gradually increasing, it is still relatively low compared with mature industries such as home appliances. The regional decentralization of dealers, the low entry and exit threshold of the industry, the persistence of long tail market demand, and the further improvement of traffic fragmentation have delayed the process of increasing industry concentration. Specifically, the following reasons include:

(1) Regional decentralization of distributors

The retail channel layout of the custom furniture industry mainly relies on dealers. Dealers have strong regional characteristics, and the business area is divided into a single city. The number of large merchants who can operate in a company is small, and the proportion of the total is low. Most dealers are mainly self-employed, so the market share in a single city is relatively low, which brings about a lower overall proportion of custom furniture enterprises. The characteristics of dealer channels determine that the custom furniture retail channel is highly fragmented.

(2) Low entry and exit barriers to the industry

The custom furniture industry has gradually formed a standard model in terms of production and manufacturing links, information systems, etc. The cost of production equipment procurement is relatively affordable, the investment in fixed assets in the early stage is limited, and small and medium-sized enterprises can rely on a mature supply chain system for production capacity construction. Therefore, the industry entry threshold is relatively low; if the operation is not good, the silent cost such as end point store closure is relatively easy to accept, so the industry exit threshold is relatively low. The above reasons for the clearance of small and medium-sized enterprises are not irreversible, and the integration process of the industry is delayed.

(3) The degree of traffic fragmentation is further improved

At present, the demand flow entrance is further dispersed, and multiple channels such as hardcover, bag check-in, and complete packaging are developing in parallel with traditional retail channels, which also affects the improvement of market concentration.

(C) the status of the company in the industry

Since 2011, companies in the custom furniture industry have landed in capital markets one after another, and have gradually attracted widespread attention. From the perspective of the overall scale of operating income and net profit and the scale comparison of sub-categories, the company ranks in the leading position in the same industry. It leads its peers in many aspects such as Product Research & Development innovation, marketing idea expansion, channel mining and expansion, and takes the lead in running out of a relatively mature and feasible business model to create more possibilities for consumers’ better home life. As a global leader in custom cabinets, the company has achieved medium and high-speed growth under the condition of high base. The leading position in the industry has been continuously consolidated. The revenue scale, end point brand influence and channel layout to reach consumers far exceed that of global companies in the same industry. With the continuous development of the company’s customized wardrobe (whole house customization) products and accessories, the revenue scale has jumped to the industry leader, and the "Oupai" brand influence has continued to strengthen among various categories, and the competitive advantage has continued to highlight.

According to the statistics of the third quarter report of 2021 of 9 listed companies in the custom home furnishing sector, the company achieved operating income of 14.40 billion yuan in January-September 2021, accounting for 38% of the sum of the operating income of the above-mentioned custom home furnishing listed companies; the company achieved a net profit of 2.10 billion yuan in January-September 2021, accounting for 51% of the sum of the net profit of custom home furnishing listed companies.

III. The company’s business during the reporting period

(A) the main business of the company

Oupai Home Furnishing was established in 1994 and is a leading one-stop high-quality home integrated service provider in China. The company is mainly engaged in personalized design, research and development, production, sales, installation and interior decoration services of whole house home furnishing products. The company started with custom cabinets and extended from cabinets to whole house products, covering whole kitchen, whole wardrobe (whole house customization), whole bathroom, custom wooden door system, metal doors and windows, soft decoration, furniture matching and other whole home products. The company is committed to customizing a unique home for each family, so that more families can enjoy high-quality home life experience.

Quanwei customization

(2) The company’s main business model

The products operated by the company mainly adopt the order-based production model, and "tailor-made" is the core of the company’s business model. The staff of the company’s specialty stores design corresponding solutions according to the customer’s house space layout and size, personalized preferences, functions, etc., and render renderings through the company’s self-developed information sales system for customers to make consumption decisions; after the customer confirms the design plan, the order is directly transmitted to the company’s production department through the information system. The company organizes production according to the order content, and finally realizes the delivery and installation of customized home products. The company adopts a vertically integrated business model, covering all aspects from raw material procurement, design and development, production and manufacturing, branding, product sales, etc., to achieve effective control of the entire industrial chain.

1. Procurement model

(1) The company’s procurement process and procurement process

The company has developed a complete management system and standard system for the procurement process to achieve unified internal material specifications and unified procurement technology Quality Standards to form the basis for large-scale procurement; establish a secondary procurement model for headquarters and bases to improve the effectiveness of comprehensive supply chain management, strengthen procurement plan management, timely and effective supply, and reduce sluggish materials. The products purchased by the company mainly include production raw materials such as plates and functional hardware, product accessories, and household accessories such as kitchen appliances.

From the perspective of procurement, the company’s procurement business can be subdivided into front-end business and back-end business. The front-end business is handled by the group’s supply chain management center and procurement center. The supply chain management center is responsible for supplier selection, assessment and evaluation, and procurement price management, so as to achieve the unification of the supply channels of the same materials in each business sector. For materials and equipment whose annual consumption reaches a certain scale, the company adopts the method of on-site invite tenders to issue invite tenders to qualified suppliers. Through on-site invite tenders to achieve the best selection and achieve the expected procurement goals; the procurement center is responsible for classifying and summarizing the amount of materials used by the group, coordinating the implementation of centralized procurement in each production base, and giving full play to the scale advantages of procurement. The procurement back-end business is the execution of specific purchase orders and material acceptance, which is mainly implemented by the physical control departments under each product manufacturing line.

(2) Raw material inventory arrangement

In order to strengthen the management of raw materials, ensure the continuous supply of materials, rationally control inventory, standardize the process of entering and leaving warehouses, and maintain the safety and integrity of assets, the company has developed a relevant system for raw material inventory management.

According to the company’s procurement implementation management measures, the material management department sets the safety inventory. The person in charge of inventory analyzes the rationality and effectiveness of material arrangement through data and inventory arrangement. If there is any abnormality, timely feedback procurement to modify the relevant material items to ensure that the material inventory is controlled in the best state that neither the production is "shut down for materials" nor the material inventory is inflated. Ensure that the number of material turnover in the warehouse meets the predetermined requirements. At the same time, strengthen the inventory period management. All kinds of raw materials and materials are set with an effective storage period. The material distribution is strictly in accordance with the first-in, first-out principle, and the daily work is strictly in accordance with the 5S management and safety management specifications in the warehouse. In the outbound management link, each production workshop counts the material demand according to the daily production task, and the inventory management department conducts the material delivery work after receiving the valid receipt credentials.

2. R & D model

The company has set up a Home Furnishing Product Research & Development Center at the group level, which is responsible for coordinating and coordinating the company’s product and technology development management work. At the same time, the company’s overall cabinets, overall wardrobes, large homes, overall bathrooms, custom wooden doors, doors and windows and other business segments have product planning and R & D departments. Each product Research & Development department of the company prepares annual new Product Research & Development tasks, temporary Product Research & Development design tasks and extended design tasks according to market trends, product sales analysis and company development needs. The R & D department, sales department, purchasing department, process department, production department, and quality department all perform their duties and cooperate in the evaluation of new materials, new product renderings, and physical samples to ensure that new products are successfully introduced to the market with excellent quality and mature technology.

The company has always adhered to original design. In addition to having a number of high-level designer teams, it has also reached strategic cooperation alliances with well-known domestic design studios, Italy and other top designers. Mature Product Research & Development management system, perfect training and R & D incentive mechanism make the company’s R & D level and innovation ability always at the leading level of the overall home furnishing industry.

3. Production model

Different from the production of standard home products, custom home enterprises generally have a series of difficulties in order processing, high information requirements, huge data volume, and high processing accuracy in the production and manufacturing process, resulting in a high threshold for large-scale home customization production. At the same time, with the advent of the digital integration era, the division of labor in the industrial chain has become deeper, and intelligent manufacturing has become a new development direction for the custom home industry.

In order to comply with the development trend of modern manufacturing industry, break through production bottlenecks, focus on the big pattern of Oupai Manufacturing 2025, and achieve another breakthrough in information construction, Oupai fully absorbs the TPS production model, based on the characteristics of the custom home furnishing industry, focusing on the three end-to-end processes of product engineering data flow (from product design to production), production information flow (from customer demand to production instructions), and production process flow (from material to finished product shipment), and using the self-developed information management system as a link to efficiently connect, integrate and integrate. In order to achieve the connection between design and digital production and manufacturing, the integration of the information system of the whole business chain, the integration of production process, equipment automation and intelligence, and maintain the leading advantage of Oupai manufacturing information in the home furnishing industry.

4. Sales model

The company adopts a compound sales model based on dealer stores, supplemented by bulk business, direct-operated stores and exports.

(1) Dealer store sales model

A. Traditional dealer model

The dealer store sales model is the main sales model in the custom home furnishing industry. It refers to the selection and cultivation of dealers who recognize their own brand value, strong financial strength, good market reputation and rich market experience, and sign a "Cooperation Agreement" with them. Authorize them to set up specialty stores to sell products produced by enterprises in specific areas, and the dealers bear their own business risks. In the process of production and operation, the company provides timely assistance and empowerment to dealer personnel training, operation and management. The advantage of the dealer store model is that enterprises can make full use of the dealer’s experience and social resources, quickly build sales channels and networks, refine market end point marketing, and form a marketing promotion strategy that is highly in line with the local market environment, which is conducive to the rapid expansion of market share.

B. Decorated home model

The continuous promotion of domestic hardcover and decoration business has a more obvious impact on the passenger flow of traditional retail channels. Among them, home improvement companies, as the front entrance, have a greater role in diverting passenger flow. In order to layout the decoration channels and expand customer resources, the company took the lead in expanding the decoration channels in the industry, and began to pilot the European home furnishing business model in 2018.

Oupai Home Furnishing refers to the company’s direct selection and cooperation with large-scale and well-known high-quality home improvement companies in various places, making full use of the company’s high branding impression, rich product categories, category matching process plate integration and other advantages, supplemented by the company’s mature information sales system, quickly import the end point of the installation enterprise, greatly improve the efficiency of the end point, shorten the running-in period, and synchronously empower the brand and product. In the entire Client Server link, the company is responsible for product manufacturing and marketing support, etc. The home improvement company is responsible for providing customized home design and installation services and home improvement design landing construction.

The expansion of the whole decoration business is conducive to the company to expand customer flow channels in the new market environment and seize market share. The company actively implements the marketing assistance policy of whole decoration dealers, and accelerates the development of whole decoration channels and the construction of marketing end point models. At the same time, the company strengthens and guides Oupai retail dealers to cooperate with local home decoration and whole decoration channel companies through mechanism design, promotes retail and whole decoration dealers to work together to activate the consumption of customized home products in the local market, and works together to complete the sales expansion of Oupai to the local home decoration market and enhance the overall share of Oupai brand.

(2) Direct-operated store sales model

The direct-operated store sales model refers to the company’s use of equity funds to open "Oupai", "Oupai", "Oupai", "Oupai" and "Oupai" series brand stores in large stores, shopping centers, and street-facing stores to sell the company’s products (including Oupai cabinets, Oupai wardrobes, Oupai bathroom, Oupai wooden doors, Oupai whole house customization, etc.). At present, the company has opened direct-operated stores in Guangzhou.

(3) Bulk business sales model

The company signs product supply and installation contracts with real estate developers or engineering contractors, and the company is responsible for the supply. The engineering service provider is the actual operator of the project performance, responsible for the design, transportation, installation and after-sales of related products. The company signs agreements with engineering service providers and supervises the performance of engineering service providers.

(4) Export sales model

There are two main modes of product export: foreign bulk business sales and foreign retail sales. Foreign bulk business sales refer to the company’s independent participation in project negotiation, contract conclusion and performance; foreign retail sales refer to the company’s sales of the "Oupai" series of household products through retail channels or in the form of choosing foreign distributors.

5, branding mode

The company attaches great importance to the construction of Oupai Home Furnishing’s series of brands, branding mainly through several aspects:

(1) Brand planning. Based on the research of enterprises, brands, industries, and consumers, elevate the company branding to the height of corporate business strategy, propose the medium and long-term development strategy of corporate brand, and guide the specific brand marketing tactics in the future. Deeply dig into the core value system of the brand, and take it as the center to establish a strong brand identity system to bring strong associations to consumers.

(2) Brand publicity. In order to standardize the company’s brand publicity, improve brand management, promote brand development, effectively protect the brand, and maximize brand value, the company has formulated a detailed brand management system, implemented various public welfare brand advertising, in-feed ads, and soft news publicity in various media channels, and actively participated in various public welfare sponsorship activities, organizing various celebrations, press conferences, promotions, and investment exhibitions.

(3) Channel layout and promotion. Fully implement the "10 + 1" end point business model. Through a wide range of distribution stores, unified and tidy design and decoration, and well-trained professionals to display the overall image of the company, improve the popularity and reputation of the "Oupai", "Oupai", "Oupai", "Oupai" and "Oupai" series brands. The company has a complete assessment, supervision and early warning mechanism for the operation effectiveness and service quality of dealers to protect the interests of end point consumers to the greatest extent and maintain the reputation of the Oupai brand. The company’s dealer management level has always been ahead of the same industry.

6. Sales logistics and warehousing models

In order to standardize the warehousing and logistics process of the company’s various categories of products, the company has formulated relevant systems covering warehousing, shipping, and material information service management, and set up a logistics center under the manufacturing system to be responsible for the logistics management of the group’s products. At the same time, in response to the lack of in-transit management in the industry, high transportation losses caused by multiple transits, and problems of wrong and missed goods, the company actively explores a new business model for customized home products logistics.

IV. Analysis of core competitiveness during the reporting period

(1) Powerful brand influence

Since its establishment 28 years ago, with its strong scale and strength advantages, Oupai has been diligently pursuing on the road of specialization, and constantly serving domestic and foreign consumers with the advantageous products of "European quality and Chinese price". The "Oupai" brand has a considerable branding impression and influence in the minds of consumers, and is gradually transforming into reputation and trust. The advertising slogan "Home, Love, Oupai" has been deeply rooted in the hearts of the people. From 2016 to 2021, Oupai was selected as one of the top 500 Chinese brands for six consecutive years with its strong brand strength, and rose year by year. In 2021, it ranked 138th with a brand value of 43.951 billion yuan. In addition, Oupai was also selected as one of the top 500 private enterprises in China’s manufacturing industry for five consecutive years. In 2019, 2020 and 2021, it won the honors of "Hurun China Top 500 Private Enterprises" and "China Top 500 Manufacturing Enterprises" for three consecutive years.

Strong end point sales system

After years of channel investment and construction, the company has established the largest marketing service network in the home furnishing industry, which cooperates closely with the group, grows together, and spreads across the country. It has the most powerful dealer (service provider) resources in the industry and distributes more than 7,000 stores. In terms of end point management, since its establishment, the company has been adhering to the concept of dealer roots, and has pioneered a perfect dealer management system such as thousand points assessment mechanism, "10 + 1" Oupai end point marketing system, double 50 theory, and storefront 4S management, and effectively implemented it. At the same time, the company conforms to the development trend of the industry, deepens the omni-channel development strategy, and builds a more mature channel operation model with retail and packaging channels as the backbone, engineering and e-commerce channels as the two wings, and direct sales and foreign trade channels as important support.

(3) The advantages of digitalization, informatization and intelligence are empowered

Yao Liangsong, chairperson of the company, said that "first-class informatization may not necessarily achieve first-class enterprises, and first-class enterprises must have first-class informatization." As the world’s largest double-material champion manufacturer of single-product custom cabinets and whole-house customization, Oupai has provided full-process digital transformation and construction after five years of enterprise transformation and upgrading. It has established a global and lean information development team including the group’s marketing information center, manufacturing information center, functional information center, and professional software company (Beijing Jiaju Technology). It has independently built core systems such as marketing support software MTDS, design software CAXA, MSCS, MOMMES, TIMS, etc., marking that the intelligent technology platform centered on cloud design, big data application, and robot flexible manufacturing has entered the practical application stage. Digitalization, informatization, and intelligence will help "make Oupai a world-class home furnishing group".

In the past five years, Oupai Informatization has taken the digitization and intelligent integration of product design and manufacturing as the R & D direction, and around the construction goal of "design and manufacturing integration, centralized planning and multi-base collaborative production, and intelligent manufacturing system support", the company has successfully built a large-scale non-standard customized home intelligent manufacturing support technology platform and an industrial Internet platform, built a full three-dimensional information model that supports the integration of large home design, display and manufacturing, and established a data mid-table and central product platform for marketing and manufacturing. All aspects of marketing, design, production and delivery have been fully digitized and cloud-based, forming a closed loop of data links, and realized the information management of the whole process from self-design to after-sales of customized products through the digital intelligence center.

(IV) Mature and efficient systematized operation advantages

The company attaches great importance to system construction and implementation. There are more than 700 business systems, covering three major system businesses: function, manufacturing and marketing. Based on the customized attributes of the company’s products, in order to respond to the individual needs of customers and the rapid changes in channels, the company adjusts its business strategy in a timely manner to gain a first-mover advantage in channel change, integration and industry reshuffle. The systematic coordinated guarantee mechanism oriented by marketing front-line needs is the end point to escort product competition, channel preemption, strategy adjustment, management upgrade and other aspects, and continues to empower, always maintaining the strong competitiveness of the European system.

Mr. Yao Liangsong, the controlling shareholder of Oupai Home Furnishing, and the company’s core management have rich industry experience in the home furnishing industry, and have a good judgment and grasp of the industry’s strategic trends, enterprise development direction, employment mechanism, and incentive measures.

And with the company’s leading position in the industry becoming increasingly stable, the company’s talent introduction strategy of "building a nest and attracting phoenix" has also been carried out smoothly, attracting more high-quality industry talents to join Oupai, and working together to achieve the grand goal of "turning Oupai into a world-class home furnishing enterprise".

(5) Strong product and process R & D and innovation capabilities

The company adheres to innovation to promote development, constantly independent research and development, innovation, and unremitting research and development of new products, new materials, new processes, and new technologies, so that the company’s process and R & D level is always at the forefront of the industry. In order to meet market demand, the company has continuously researched and explored in the fields of product process structure design, new material development and application, and process quality management. The company’s leading process technology level provides a strong technical guarantee for the production of high-quality customized furniture products. The company continues to improve and innovate production technology, uses informatization as a tool and means to promote the improvement of process technology, establishes a technical talent incentive assessment mechanism with results as the guide, and establishes a perfect process-level process control system.

After years of hard work, the company’s product development has gradually transitioned from single product customization to whole-house customization, whole-house customization, and from single new product design to new product design, extension design, and functional design. As of December 31, 2021, the company and its holding subsidiaries owned a total of 595 patents and 84 computer software copyrights.

(6) Flexible large-scale non-standard customization capacity

In the early 1990s, Europai took the lead in introducing the concept of European "integrated kitchen" to China, pioneering the industrial production of modern cabinets in China, and was known as the advocate of China’s "kitchen revolution". With the company’s continuous R & D investment over the years, deep technical process reserves, leading home furnishing R & D strength, and bargaining power in the upstream and downstream of the industrial chain, the company has explored a large-scale non-standard customized product manufacturing model with Europai characteristics. At present, the company’s total production scale of customized furniture products ranks first in the industry. The company’s production capacity design is based on the national layout and large home furnishing strategy, relying on manufacturing to build four production bases: East (Wuxi Base), South (Qingyuan Base), West (Chengdu Base) and North (Tianjin Base), forming a national capacity radiating East China, South China, West China and North China.

V. Main operating conditions during the reporting period

During the reporting period, the operating income was 20.442 billion yuan, an increase of 38.68% year-on-year, and the net profit attributable to shareholders of listed companies was 2.666 billion yuan, an increase of 29.23% year-on-year.

VI. Discussion and analysis of the company’s future development

(I) Industry patterns and trends

1. According to the research data of the "2021 China Internet Home Furnishing Development White Paper", the consumption of home users is developing in a rational direction. In the choice of home building materials, 82% of the survey users value the environmental protection, health and safety of home building materials the most, and 77% of the survey users value health and comfort the most in the choice of furniture. Based on the upgrade of consumers’ demand for environmental protection and health, on April 16, 2021, the company exclusively released "Alaldehyde-free Healthy Home 2.0", and used it to launch the second generation of aldehyde-free additions with five functions of formaldehyde-free addition, its own net aldehyde, antibacterial, mildew-proof, and net taste – the net aldehyde antibacterial love core board, leading the whole house customization industry to start a new round of environmental protection upgrades, and solving the home environmental protection problems that have plagued consumers for many years. The second-generation formaldehyde-free addition technology is independently developed by the company, and it is difficult for industry brands in the same industry to quickly follow up on technology in a short period of time, which further strengthens the company’s differentiated positioning and advantages in environmental protection product technology upgrades, and continues to consolidate its leading position.

Data source: "China Internet Home Furnishing Development White Paper 2021", Douyin Home Furnishing Interest User Survey, September 2021

2. In terms of channels, the passenger flow structure continues to adjust, the growth of traditional channels is under pressure, and the integration of traffic fragmentation has become a medium- and long-term trend. In terms of categories, multiple categories are integrated and penetrated into each other, and the boundaries between categories are gradually blurred. Due to the low barriers to entry in the industry, end point demand presents a long tail distribution, and there are a large number of small and medium-sized enterprises in the industry. The repeated appearance of epidemics has accelerated the industry reshuffle and competition landscape optimization. Some small and medium-sized enterprises have taken the initiative to withdraw from the market due to capital turnover, customer acquisition pressure, etc., which is conducive to the concentration of market share to the leader. Customized furniture head enterprises have shown In addition, following the big home furnishing strategy, the whole decoration channel has become an important direction of active layout and implementation in the development planning of many customization enterprises. The whole decoration company and customization enterprises have promoted the market share from the decentralized long tail to the concentration in the form of specialized division of labor.

3. Based on the macro-economic level and the industry environment level, the company’s competitive advantage is mainly reflected in the first-mover advantage of strategic layout and the product advantage, brand advantage, channel advantage and informatization advantage accumulated therefrom. The first-mover advantage of strategic layout is reflected in continuously leading the development path of the industry, tapping growth opportunities ahead of peer companies, and forming a good demonstration and leading effect to lead the industry to explore new growth momentum. Product advantage is reflected in the company’s strong Product Research & Development and design capabilities, fully launching high-environmental performance and high-value products according to consumer needs. Brand advantage is reflected in the company’s continuous consolidation of influence in retail, bulk, and complete packaging channels, multi-category formation of multi-dimensional growth, and continuous improvement of brand influence. The channel advantage is reflected in the perfect end point store layout, and the end point operation quality is continuously optimized and surpasses the average level of the same industry. The advantage of informatization is reflected in the company’s active investment and realization of cross-category and whole-process comprehensive connection. In recent years, from catching up to surpassing, it can continue to drive the efficiency improvement and cost optimization of front-end and back-end order-receiving design and production and all aspects of the whole category. Based on the above advantages, the company’s position as a leading enterprise in the industry has been further consolidated. The Matthew effect is significant. The growth rate of revenue and net profit can still exceed the industry average in the case of a high base. It is expected to achieve a higher market share of all channels and multiple categories in the process of market from dispersion to concentration, give full play to the scale effect, reduce costs and increase efficiency, and obtain good sustainable profitability.

4. In addition, the national level also actively guides and promotes the continuous development and growth of the company’s industry, and encourages excellent enterprises with a sense of social responsibility to continue to provide consumers with safe, reliable, healthy and environmentally friendly green home products:

(1) The government work report of the two sessions: Adhere to the same tone of housing without speculation, promote the construction of affordable housing, support the commercial housing market to better meet the reasonable housing needs of buyers, stabilize land prices, housing prices, and expectations, and promote a virtuous circle and healthy development of the real estate industry due to urban policies.

The stable development of the real estate market will help provide an important foundation for the demand of the home furnishing industry in the post-cycle sector, fully meet the reasonable housing demand, and promote the healthy development of the rigid demand market.

(2) On March 4, 2022, the China Banking and Insurance Regulatory Commission and the Central Bank issued the "Notice on Strengthening Financial Services for New Citizens", the main contents of which include: first, implementing differentiated housing credit policies according to city policies, reasonably determining the standards for mortgage loans for new citizens who meet the purchase conditions, and improving the convenience of borrowing and repayment; second, reasonably meeting the demand for housing credit for new citizens who meet the requirements of the housing purchase policy and have the ability to purchase houses and relatively stable incomes; third, providing consumer credit products for the reasonable needs of new citizens in the transition stage of entering the city and settling down.

By providing consumer credit products, it helps to ease consumers’ current consumption pressure and promote the release of demand for furniture, home appliances, and other products.

(3) In February 2021, the "Opinions of the Central Committee of the Communist Party of China and the State Council on Comprehensively Promoting Rural Revitalization and Accelerating the Modernization of Agriculture and Rural Areas" was issued: Article 18 of it states that it is necessary to comprehensively promote rural consumption, "Accelerate the improvement of the three-level rural logistics system in counties and villages, transform and upgrade the rural delivery logistics infrastructure, further promote e-commerce into rural areas and agricultural products out of villages and cities, and promote the effective connection between urban and rural production and consumption. Promote the replacement of durable consumer goods for rural residents."

By promoting the upgrading of durable consumer goods for rural residents, it will help furniture companies to fully channel down and expand their coverage of the third-level market in counties and villages.

(2) Company development strategy

"There is a family, love and Europai" is not just a well-known advertising slogan, but also the glory and goal we have been working for for 28 years. The company’s corporate vision is positioned to "make Europai an excellent home furnishing enterprise in the world". Looking at the present, in the face of the rapid changes in the industry, in a world of great change, only by taking advantage of the trend can we always stand at the forefront. To this end, the company will continue to work around the "three horses and one car" strategy:

1. Informatization strategy: The successful application of Oupai informatization, firstly, improves the user experience, users can feel the warmth of the future home through 3D model browsing, high definition rendering graph, 720 degree rendering and small video in the design stage; secondly, the direct application of design data has greatly improved the accuracy and efficiency of all aspects of quotation, order placement, order splitting, technical review, price review and settlement; thirdly, the improvement of the accuracy and efficiency of these links means that the order design, order conversion cycle, product delivery cycle is shortened, and there are fewer errors. In addition, Oupai informatization conforms to the development needs of the whole group’s customization in the future. In the future, Oupai Informatization will also empower retail distributors to expand new business models through innovative technologies such as the Internet, big data, cloud computing, AI artificial intelligence, and supply chain collaboration, and reconstruct the business ecosystem, industry industry chain, and value chain of big home furnishing. Innovate and change the traditional customization model and upgrade it into a modern, one-stop delivery, and a new generation of big home furnishing business models.

2. Building a big home model: Oupai is the first enterprise in the industry to propose a breakthrough big home development strategy. The core of this strategy is to grow from a single product provider to a home integration solution provider to solve the needs and pain points of consumers and channel providers. Driven by the dual advantages of first-mover advantage and enterprise organization and operation coordination ability, Oupai’s big home strategy will continue to move forward: on the one hand, quickly perceive and deepen the research and creation of a variety of big home models, and explore a big home development path that conforms to the situation of Oupai enterprises and adapts to the market situation; on the other hand, continue to explore the integrated sales business model of cabinets +, high-end whole-house customization of wardrobes + home accessories, bathroom +, customized wooden door systems and other categories.

3, fully optimize the end point: while maintaining the advantages and status of the original channel, the company will actively layout home improvement, complete, bag, electricity supplier, foreign trade channel business, channel management, system management and innovation management in parallel, and constantly optimize the management mode, multi-dimensional pilot new model, constantly enrich and upgrade the end point sales form.

4. Branding: In the context of consumption upgrading, consumers present outstanding characteristics such as youth, branding, health, and intelligence, which is a new direction for future brand promotion strategies. Brand reputation, as one of the core elements of enterprise development, will bring better customer stickiness to the products and services of brand enterprises, and also bring a broader imagination space for the development of brand enterprises. The company will continue to carry out branding and management through multiple channels and forms, so that "home, love, and European school" will be more deeply rooted in the hearts of the people.

(III) Business plan

In 2022, the company will respond calmly, prepare its troops and move forward through the ice. In 2022, the company strives to achieve a year-on-year increase in operating income of 15% -20% and a year-on-year increase in net profit of 10% -15%. (Special Note: The above is intended to clarify the company’s operating and internal management control goals, and does not represent the company’s 2022 profit forecast, nor does it represent a substantive performance commitment to investors. Whether the above goals can be achieved depends on many factors such as the macroeconomic environment, market conditions, industry development and the efforts of the company’s management team. There are certain uncertainties. Investors are advised to pay attention to investment risks.)

1. Continuous strengthening of operation and management capabilities

The marketing system always adheres to the consumer demand, end point operation as the core, and the company’s production and manufacturing, functional systems to work together to form a solid pincer-shaped offensive situation, expand the share, bill of lading value, and continuously upgrade the information capability as a series, so that the system can operate more streamlined and efficient, integrate the resources of all parties, and further build the company’s mid-platform operation and management advantages.

2. Open up a new shore on the road to big home

Under the market background of the continuous rapid switching of traffic trends, omni-channel layout, full-field expansion, penetrating old channels and deepening new channels, giving full play to the advantages of the company’s big home brand platform, building nests to attract phoenix, enriching the new connotation of one-stop consumption of big home, grabbing traffic from outside and digging stock from inside. Combining the leading advantages of the company’s two core categories of overall cabinets and whole house customization, through mechanism design, end point marketing strategies, and information tools, to achieve the growth and integration of various categories of Europai, further establish an absolute competitive advantage from the system, and launch a new impact on higher goals with the attitude of an industry leader.

3, the depth of information technology empowers the big home strategy

On the basis of the realization of scene marketing and delivery based on full three-dimensional models for multi-space, all-category customized furniture, home distribution, etc., Oupai’s information capabilities are gradually growing rapidly and iteratively towards the digital capabilities of the overall space design, the whole scene marketing and delivery of the big home. The cooperation and delivery of all aspects of the big home involves a large number of space, products, manufacturing and construction processes and their supply chain data, data processing and accumulation. Oupai’s digital capabilities are also a necessary ability for Oupai to cooperate with the whole decoration company to empower the whole decoration business.

Oupai is a strategic advocate of large-scale home furnishing, from single-product refinement and enlargement, to whole-house customization, whole-house customization, and then to whole-home furnishing, step by step to promote the innovative business model of "all-category integration + all-digital design, manufacturing and operation"; and through digitalization and intelligence to solve the contradiction between personalized customization and large-scale production, with high-value product power, software technology, innovation ability, advanced flexible production technology, cloud computing and big data practice, on the basis of the three existing core competitiveness of Oupai, it has created the fourth core competitiveness – the core competitiveness of all-digital design, manufacturing and operation, and has become the benchmark of the Made in China 2025 National Action Plan in the customized home furnishing industry.

(Iv) Possible risks

1. Risk of market changes

In 2020, the COVID-19 epidemic broke out at home and abroad. Under the correct guidance of the party and the government, our country’s epidemic has been effectively and comprehensively controlled, and valuable experience in epidemic prevention and control has also been obtained. However, throughout the international community, the haze of the epidemic has not completely dissipated, and the epidemic prevention and control situation is still severe. The operating environment and supply chain of domestic and foreign markets will also face uncertainty, which will bring uncertainty to the company’s production and operation goals in 2022.

2. The risk of increased market competition

The custom furniture industry in which the company is located belongs to the furniture sub-industry. As an industry leader, the company has strong advantages in design and development, brand, service, and channels. However, due to the shift period of the custom furniture industry from high-speed to medium-high-speed growth, coupled with the increase of cross-border entrants in the industry, the release of production capacity of listed companies’ fundraising projects, and the fragmentation of passenger flow, the change of internal and external factors will lead to industry competition from low-level competition in product prices to a composite competition level composed of brands, networks, services, talents, management, and scale. The intensification of market competition may lead to a decline in the average profit margin of the industry, which will bring uncertain impact on the company’s operating performance.

3. Risk of fluctuations in raw material prices

The raw materials of customized furniture products produced by the company include particle board, medium fiber board, functional hardware, quartz stone board and some purchased electrical appliances. In the past three years, the company’s direct material costs have a high proportion of production costs, and changes in raw material prices have a greater impact on the company’s production costs. Since the end of 2020, the prices of major raw materials have risen, and they are still running at a high level as of now. If the purchase prices of raw materials fluctuate violently in the future, it may have an uncertain impact on the company’s profitability.

4. Dealers manage risk

Dealer store sales is the main sales model in the custom furniture industry. Dealer store sales model is conducive to custom furniture enterprises to expand their marketing network with the advantage of dealers’ regional resources, and to effectively penetrate the market at all levels and improve the market share of products. Although the company and dealers have agreed on each other’s rights and obligations in the cooperation agreement signed, and have carried out unified management of dealers in store image design, personnel training, product pricing, etc., if individual dealers do not follow the agreement to sell, business publicity may bring uncertainty to the company’s brand perception.

5. Brand management risk

The company’s products are durable consumer goods, and the brand represents the quality and connotation of the product, which is an important factor affecting consumers’ purchase choices. After years of efforts by the company, the "Oupai" brand has a high reputation and reputation in the domestic market. If the company or distributors have problems in trademark management, store image, product quality management and after-sales services, it may bring uncertainty to the company’s brand perception.

6. Product quality risk

The company has always regarded product quality as the cornerstone of enterprise development. The company’s production technology is advanced, the process is perfect, the quality control standards are strict, and the quality control measures are complete. The products undergo strict quality inspection before leaving the factory, but this cannot completely rule out the possibility of quality problems after the products are used. Once a quality problem occurs, even in the case of non-company responsibility, consumers may have disputes with the company, which will cause uncertain impact on the market sales of the company’s products.