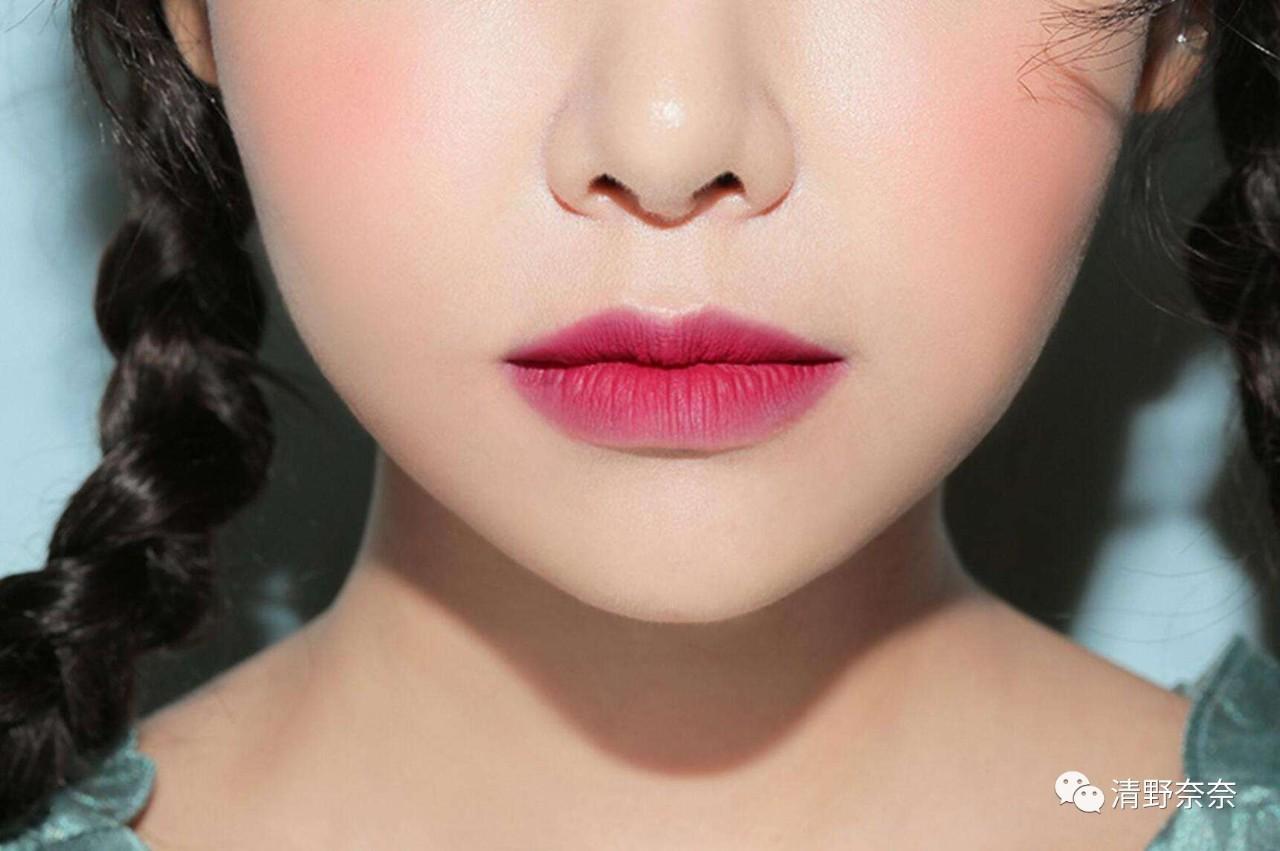

A picture represents a culture.

What is culture? Writing is "recording, expressing and commenting", while culture is "analysis, understanding and tolerance". The characteristics of culture are: history, content and story. Many philosophers, sociologists, anthropologists, historians and linguists have been trying to define the concept of culture from the perspective of their respective disciplines. The above is a slightly official interpretation. I only interpret the word "culture" from a personal point of view or a biased point of view. Culture is root-seeking and positioning!

The second generation of grandparents and grandchildren read Disciples Rules.

Searching for roots means knowing where you come from.

As individuals, seeking roots means knowing who our ancestors are, and then we have some traditional clan genealogy. Who are our parents, grandparents and great-parents? I have been looking for it all the time. In the past, some people said that this person is well-rooted, well-born, and there are no unscrupulous people in the clan for three generations. He is a reliable person. What I am talking about here is his origin. Some big families have also formed their own clan culture. For example, Zeng Guofan once left a 16-character proverb: "If you are frugal, you will prosper, and if you are diligent, you will be healthy; Be diligent and frugal, and never be poor. " Manage the family by frugality.

Zeng GuofanI have always asked my family to live frugally and stay away from luxury. When he met aristocratic men in Beijing who were blindly extravagant, corrupt and profligate, he refused to let his children live in Beijing. His original wife has been leading her children to live in their hometown in the countryside, and the plaques of "Xiangfu" and "Houfu" are not allowed to hang outside the door. Zeng Guofan demanded that "we should be honest and frugal, and swear not to send any money to our families." My wife has no spare money at home, and cooks and textiles herself.

Diligent in learning. In addition to "frugality", Zeng Guofan’s other requirement for his children is "diligence". Zeng Guofan insisted on writing letters to his children, correcting poems for them and discussing various problems in his studies and life. He wrote to his son, Ceng Jize, asking him to dress neatly after getting up every day, to greet his uncle and uncle first, and then to clean all the houses before sitting down to study, practicing 1,000 words every day.

Zeng Guofan also urged his family to keep studying every day, and drew up a strict study plan for the whole family many times: "My family’s men are indispensable in reading, writing and writing. Women are indispensable for clothing, food, coarse (work) and fine (work). "

Attach importance to family education. Zeng Guofan had three sons and five daughters, and his youngest daughter, Ceng Jifen, lived to be 91 years old. In 1875, Ceng Jifen married Nie Jia in Hunan. Zeng Guofan stipulated that each daughter’s dowry should not exceed 200 taels of silver when she gets married, and there is also a homework list written by her father. Zeng Guofan wanted to train his daughter to be a diligent housewife. In fact, her daughter did better than her father expected.

A good clan culture can make a family flourish, as well as a nation. The nation is talking about history. China has a long history of 5,000 years. China people are honest, hardworking, brave, simple and intelligent, and there are many cultural classics handed down, such as the Book of Changes, the Tao Te Ching, the Analects of Confucius and Mencius. All dynasties pay attention to cultural inheritance, and all dynasties pay attention to the compilation of historical books, such as Zi Zhi Tong Jian, which we are familiar with. For this inheritance that we should criticize, we should take what we have and give up, publicize it well, and abandon what does not meet the needs of contemporary society. China is also known as the country of etiquette, especially Confucius has always emphasized the rites of Zhou, and people pay attention to etiquette when they communicate with each other. The younger generation should salute when they see their elders, and the lower level should salute when they see their superiors. Confucius has always emphasized benevolence, righteousness, propriety and wisdom, including the wisdom of the sages. If we don’t pay attention to inheritance and study, we won’t know our own culture. Then you don’t know your position.

As a country, it also needs cultural orientation, such as the 24-character socialist core values: prosperity, democracy, civilization, harmony, freedom, equality, justice, the rule of law, patriotism, professionalism, honesty and friendliness.

Culture is positioning.The Tang Priest has a classic sentence in Journey to the West: The poor monk Tang Xuanzang came from the Tang Dynasty in the east and went to the Western Heaven to worship the Buddha for Buddhist scriptures! This sentence illustrates the problem, always know.Who are you? Where are you from? What are you doing? Where are you going? This is positioning.I’m Tang Xuanzang: I’m invited by the king of Tang to learn from the scriptures. My mission is to learn from the scriptures and constantly beat myself. I can’t complain about the superior king of Tang, the imperial court or bow to difficulties. At present, some Chinese people, as Chinese people, complain about the country all day, especially abroad, and forget who they are. Eating China’s water and food, instead of cursing the motherland and cursing mothers, such people are called unfilial descendants and forget their roots, but if they are also like this abroad, their nature will change, that is, the scum of the nation will become fake foreign devils. Especially in today’s epidemic, some clowns are jumping up and down and gossiping.

The word "filial piety" is from the old to the child, and the younger generation should honor the elders.

where i was from?The word "filial piety" is interpreted in Shuo Wen Jie Zi as being obedient to the old. Performance is inheritance, inheritance, and the premise of inheritance and inheritance is recognition, and recognition contains the meaning of respect and affirmation. Personally, we should recognize our parents, that is, respect and affirm their advantages, and our lives are subject to their parents, so we should know how to be grateful; The traditional genes of parents should be recognized, such as hard work, kindness and other good things, of course, they should be critically inherited and objectively evaluated, and they should be divided into two and not go to extremes. A family is like this, and so is a country and a nation. Don’t always scold your mother, you are not filial, and the luck of unfilial people is not much better! Because some genes in your parents come to an abrupt end on you, denying your ancestors, and your soul track has changed. . . . .

When it comes to filial piety, it means recognition first, and recognition at its peak means worship, and worship means reverence. China’s gods are all human beings, such as Fuxi, Guan Gong, Zhao Gongming, Yue Fei, etc. If we worship Guan Gong because of his loyalty, our fate will only change if we become such a person. Of course, more people pray for Guan Gong to protect and take care of themselves, because he has skill and he is a god, but the prerequisite for this kind of god to bless you is that you need it. We worship Guan Yu, and more importantly, we should straighten our mentality, learn to let go and become loyal people. When we worship a bodhisattva, we learn to be like a bodhisattva, learn to help others, and there is a saying that helping others is actually helping ourselves. The ancients paid attention to helping others and helping themselves. What kind of person you worship must be, so it will work, otherwise you can only be given a sentence: don’t burn incense at ordinary times, cram for the Buddha’s feet temporarily. Buddha can’t help you if you don’t do a good job in the early stage and worship Buddha temporarily.

Guan Gong pays attention to loyalty and righteousness.

Culture includes a lot of contents, too. Culture is condensed in the material and dissociated from the material. The history, geography, customs, traditional customs, lifestyle, literature and art, code of conduct, way of thinking and values of a country or nation that can be passed down are endless. Let’s stop here today! If you are not finished, please leave a message in the comments section!