Differentiated Positioning, Characteristic Management, New Network Bank Practice Digital Technology inclusive finance

Differentiated Positioning, Characteristic Management, New Network Bank Practice Digital Technology inclusive finance

Chengdu, Sichuan News Network, March 12-The orderly landing and sustainable operation of inclusive finance are still the focus of attention of all parties. In this year’s "two sessions" government work report, Premier Li Keqiang clearly proposed to "reform and improve the financial service system, support financial institutions to expand their business in inclusive finance, and strive to solve the financing difficulties and expensive problems of small and micro enterprises."

At the press conference held on March 2, "CBRC defuses financial risks and leads the high-quality development of banking service economy", the head of the Urban Banking Department of CBRC fully affirmed the positive role played by private banks in lowering the financing threshold, reducing bank operating costs and customer costs, and broadening financing channels. He said that CBRC would guide private banks to adhere to differentiated market positioning and actively practice inclusive finance.

As the seventh private bank approved for construction in China, it is also the third internet bank in China and the first internet bank in the central and western regions. Since its opening in December 2016, Sichuan Xinwang Bank has adhered to the differentiated positioning of "mobile internet, inclusive compensation" and the characteristic operation of "digital inclusive and universal connection" with the help of scientific and technological means such as mobile internet, big data, cloud computing and artificial intelligence, and complemented the advantages of prime bank with the role of "complement".

The person in charge of the Urban Banking Department of the China Banking Regulatory Commission said at the press conference that all 17 private banks have been opened, and their business development is generally stable, with rapid growth of assets and liabilities, good profitability and low overall risk. It is worth mentioning that: "Private banks have bright spots in serving the people and many unexpected gains."

First, effectively lower the financing threshold. Private banks actively use technologies such as mobile internet and big data mining to help many customers who lack credit records and collateral to obtain credit support, effectively lowering the financing threshold.

The second is to innovate risk control means to achieve "speed up and reduce costs". Some private banks use digital risk control system to replace the traditional manual processing of banks, and realize automatic, batch and low-cost pipeline credit lending, which not only reduces the bank operating cost and customer financing cost, but also effectively reduces the time for loan customer application and bank review, and achieves the customer experience of "second-by-second loan and real-time loan".

The third is to enrich financial products and broaden financing channels. Some private banks have enriched credit products, improved credit processes and helped broaden financing channels in view of the financing needs and practical difficulties of different types of customers, effectively alleviating the problem that small and micro businesses are difficult to obtain financing due to the lack of collateral and business data.

Adhere to the positioning of the new network bank and focus on "digital inclusiveness"

As a pilot of the second batch of private banks, Sichuan Xinwang Bank was jointly established by New Hope Group, Xiaomi and Hongqi Chain. At the beginning of the approval, Xinwang Bank actively responded to the regulatory requirements, taking serving small and micro groups and supporting the real economy as its fundamental purpose, building big data risk control and financial technology as its core competence, focusing on deepening inclusive finance by digital means, and providing convenient and efficient financial services for 80% of small and micro groups that have not received perfect financial services.

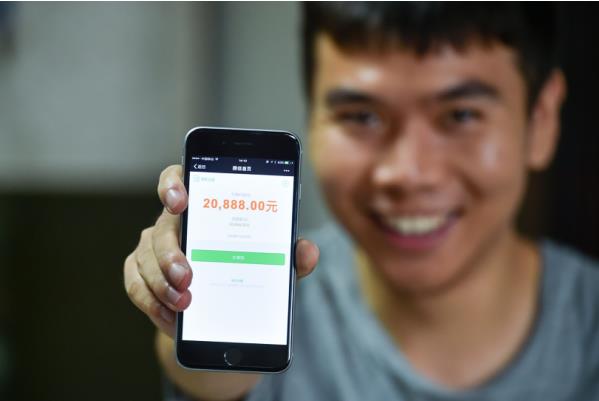

In Xinwang Bank, users don’t need to go to outlets and submit paper materials. They can apply at any time and place for 7*24 hours with only one mobile phone, and apply for loans every second, lend in real time, and pay them back with the loan, which greatly improves the availability of financial products and effectively reduces the time and cost of applying for loans for users.

As of January 23, 2018, there were more than 10 million users of Xinwang Bank, covering 31 provinces, municipalities and more than 300 cities across the country, and users in remote areas of fourth-and fifth-tier cities such as Bazhong, Dazhou and Nanchong in Sichuan, as well as users in Beijing, Shanghai, Guangzhou, Shenzhen and Chengdu, who can obtain convenient and efficient financial services. Statistics show that nearly 30% of users have never enjoyed financial services and lacked credit records before applying for a loan from Xinwang Bank.

In terms of financing amount and service cycle, the credit products of Xinwang Bank also have the characteristics of small amount, high frequency, fragmentation and generalization. The minimum loan can be borrowed from 500 yuan, and the shortest loan can be borrowed for one day. By the end of 2017, the per capita loan amount of Xinwang Bank users was 3,300 yuan, and the average loan period was 75 days.

Financial technology injects new development momentum into banks.

In this year’s government work reports of the two sessions, scientific and technological innovation and innovation drive have also been mentioned many times. At present, technologies such as big data, cloud computing, artificial intelligence and blockchain have been deeply integrated with the financial industry. For a long time to come, financial technology will inject new development momentum into financial institutions.

As Liu Yonghao, member of Chinese People’s Political Consultative Conference and chairman of New Hope Group, said in the panel discussion of CPPCC, with the country’s reform and opening up and more and more open policies, private enterprises have advantages in the new economic fields represented by mobile Internet, big data and artificial intelligence.

In the field of new finance, as the first batch of banks that comprehensively use machine learning technology to make retail credit risk decisions, Xinwang Bank is driven by financial technology to continuously improve service efficiency and optimize user experience.

In the core risk control link, Xinwang Bank has independently developed an anti-fraud system, which comprehensively uses technologies and means such as face recognition, bio-probe, device fingerprint and associated network to control the anti-fraud risk. At present, it can complete the parallel execution of hundreds of rules under the current business volume, and can output results in milliseconds. By the end of 2017, the anti-fraud system effectively blocked 600,000 risk fraud attacks, ensuring the safe and smooth progress of business.

At the level of real-time credit decision-making, Xinwang Bank also uses artificial intelligence and machine learning algorithms to make real-time portraits, analysis and judgments of users. At present, 99.6% of the credit business has been approved by machines in the whole process, and only 0.4% of large credit and suspicious transactions need manual intervention, and the audit results can be output in 7 seconds at the earliest, which greatly improves the efficiency of credit approval and saves the operating costs of banks.

Under the support of financial technology, Xinwang Bank knows that it shoulders the responsibility and mission of "supporting the real economy, serving small and micro groups, and practicing inclusive finance", and will fully stimulate its dual genes of finance and Internet, adhere to differentiated positioning and characteristic operation, and rely on big data risk control and technology and finance capabilities to build a digital technology universal bank and practice digital technology inclusive finance.