Investigation on the chaos of "campus loan": college students committed suicide because they were unable to repay.

CCTV News:In recent years, all kinds of "campus loan" advertisements have flooded college campuses. This kind of loan focuses on "low interest rate" and "quick review", attracting a large number of college students’ loans. However, some students have paid a heavy price after taking out loans.

In early October this year, Xiaolu, a college student in Nanning, Guangxi, borrowed more than 1.6 million yuan from his classmates in the name of doing business, but he was unable to repay 900,000 yuan because of gambling, leaving a suicide note, which also triggered social concern about campus loans again.

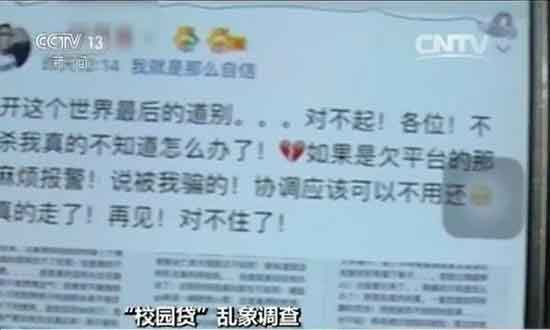

On October 9th, Xiao Lu posted a message on QQ space, saying that he had borrowed more than 900,000 yuan from his classmates, and he had to die because he lost all his gambling addiction. After the news spread among Xiaolu’s relatives and friends, the pot exploded.

Xiaolu QQ space message

According to everyone’s statistics, Xiao Lu borrowed money from hundreds of people on the grounds of reselling mobile phones and concert tickets, and reselling them by stages. The single amount ranged from 1,000 yuan to 300,000 yuan, with a total of more than 1.6 million yuan.

Xiao Lu’s family is good, and his usual life is much more luxurious than that of ordinary college students. Just because I saw Xiao Lu’s generosity, I believe he made money well. Many students borrowed money from various lending platforms and gave it to Xiao Lu to take care of. Shen is one of them. He told reporters that his monthly living expenses were 1,200 yuan, and he couldn’t save any money at ordinary times. Xiao Lu asked him to lend in installments from the online loan platform.

Xiaolu Weibo

At first, every time he made repayment, Xiao Shen was given money on time until he learned of Xiao Lu’s death. Xiao Shen panicked. He borrowed nearly 300,000 yuan to Xiao Lu through various online lending platforms. Nowadays, how to return the money owed on the online lending platform has become a big problem.

With Shen have the same experience, and Xiao Juan. Xiao Juan said that since the beginning of this year, she has borrowed 13,000 yuan from two online loan platforms, and all the money she borrowed was given to Xiaolu for investment. Now, she has to pay these debts herself.

Coincidentally, in March this year, Zheng, a college student in Henan Province, made an online loan of 589,500 yuan in the name of 28 classmates, which failed to be used for gambling. Finally, he was overwhelmed and went to the dead end, ending his 21-year-old life. After the matter was reported by the media, people paid close attention to campus loans.

Most students spend money with loans.

"Campus loan" provides a platform for students to get a lot of cash easily without their families. It is quickly sought after by college students, but it also has many traps.

During the interview, more than half of the students said that they had heard or used campus loans, and the projects they borrowed were various.

College students interviewed

In addition, renting a house, buying a mobile phone, buying a bicycle battery car, etc. are also common items for college students to use campus loans.

Campus loan interest is amazing.

It is understood that at present, campus loans are mainly divided into three forms. One is a staged shopping platform specifically for college students, and some platforms provide lower cash withdrawals; The second is the P2P loan platform, which is used for college students to help students and start businesses; The third is the credit service provided by the traditional e-commerce platform. Famous school loan and excellent installment are two common online loan platforms for college students. In official website, a famous school, the reporter noticed that the number of people applying for loans has exceeded 1.6 million, and the amount of loans applied for ranges from 100 yuan to 50,000 yuan.

On the website of an online shopping platform, the reporter noticed that the price of a 64G iPhone 6s on the website is 5499 yuan, and the borrower needs to repay 6599 yuan in 12 installments, of which the interest is nearly 1100 yuan, and the calculated annual interest rate is as high as 20%, which is much higher than the benchmark interest rate of bank loans for the same period.

Small advertisements posted on campus

The reporter found that advertisements for small loans can be seen everywhere in the study rooms, dormitory buildings and bulletin boards of schools. These advertisements are all under the banner of low risk and low interest rate. You can get money with your ID card alone, and the amount can be tens of thousands. It sounds as if the loan threshold is very low. The reporter communicated with the person in charge of the loan according to the micro signal left in the advertisement. The person in charge said that they get the money by installment. If they want to borrow 10,000 yuan, they have to pay for two Apple phones by installment, usually for 24 months. In addition to paying 1,100 yuan as the person in charge to forge identity, they have to pay about 300 yuan’s interest every month. According to the algorithm provided by the person in charge, if you want to borrow 10,000 yuan and repay it in 24 installments, the amount that students will eventually have to repay is 18,300 yuan.

The use of campus loans endangers the safety of college students.

In April 2016, the Ministry of Education and the China Banking Regulatory Commission jointly issued the Notice on Strengthening the Risk Prevention and Education Guidance of Bad Campus peer-to-peer lending, explicitly requiring universities to establish a daily monitoring mechanism and a real-time early warning mechanism for bad campus peer-to-peer lending, and at the same time, establish a response and disposal mechanism for bad campus peer-to-peer lending.

Despite this, due to the lack of strong supervision, campus loans with low interest rates still attract a large number of students. In addition to claiming low interest rates, many "campus loans" will also focus on the selling point of "quick review", and the time from application to review and successful loan is very short.

In 2015, the Credit Management Research Center of China Renmin University wrote "Investigation Report on National College Students’ Credit Cognition", which interviewed nearly 50,000 college students in 252 colleges and universities. The report shows that 8.77% of college students will use loans to obtain funds, of which online loans account for almost half. As long as you are a student at school, you can easily apply for a credit loan by submitting information online, passing the examination and paying a certain handling fee. However, while campus loans bring convenience to students, they also cause more and more tragedies.

In June 2016, the media exposed that loan sharks used some peer-to-peer lending platforms to provide "naked loans" to college students. In the "naked loans", girls borrowed money with nude photos with ID cards as collateral. If the loan interest agreed by the borrowers and borrowers privately was 10%, they would have to pay 20% of the deposit and 15% of the agency fee to the loan platform, which was equivalent to only 6,500 yuan when they borrowed 10,000 yuan, but the repayment and repayment. At this time, students may not have noticed that the platform still has an annual interest rate of 24%. In fact, the loan interest rate is as high as 30% to 40%. If the money is not paid, there are high overdue management fees, and some are even forced to take nude photos. This also reflects the hidden crisis of campus loans.