In the deep case of last November, "Why is Cyrus’ financial report still deteriorating? ",Miao tou once gave a conclusion based on the analysis of depth-Huawei was very strong, but at that time it still couldn’t make up for Cyrus’ own shortcomings.

The reason is also very simple:Although Celestial achieved the reversal of the sales trend by "configuration adjustment+70,000 yuan sharp price reduction" for the new M7 at the end of 2023, overall, the deep cooperation with Huawei did not help Celestial to establish its "high-end+high gross profit" brand positioning.

The decline of the brand in the world from "luxury" to "mainstream" immediately caused Cyrus to directly fall into the "quagmire" that all new car-making forces have to face:Without price reduction, there is no sales volume, and the scale can increase. However, because the scale is not large enough and the average cost decreases slowly, it is very difficult for the financial level to achieve a break-even point, let alone realize the benign development of car companies.

The trend of Celestial in the following months (red arrow) also confirmed our judgment. Although the sales volume of the new M7 soared for several months in a row, its share price actually went down in November, with the largest retracement reaching 37.6%, exceeding 32.4% of the whole vehicle sector in the same period.

By February of this year, the share price of Cyrus had another obvious change: first, it rose directly by 59.5% in more than a month., from a low of less than 60 yuan/share to a high of more than 100 yuan/share; Then from mid-March, it continued to decline, with a cumulative withdrawal of 17.6%, and now it is less than 90 yuan/share..

Let Cyrus go out of the clear upward share price, which is the brand-new flagship product M9 that it officially began to deliver this year. Numerous data show that it has achieved incredible performance figures in the industry. The sharp shock in the market also shows that there are still doubts and differences in the market about this product, including the changes it can bring to Celeste.

Under the premise that the detailed data of the 2023 annual report will not be released until the end of April, why did Cyrus’ share price rise ahead of schedule? Why is M9 a "miracle" for Cyrus? How should Cyrus’ performance in 2024 be expected? How should we adjust our expectations for Cyrus and some new car-making forces?Today we will focus on these three issues.

Why did Cyrus turn upside down?

As early as the end of January this year, Cyrus announced the expected loss of its performance in 2023: it is estimated that the operating income will reach 35.5 billion yuan to 36.5 billion yuan in 2023, up by 4.09% to 7.02% year-on-year; The net profit loss of returning to the mother was 2.1 billion yuan to 2.7 billion yuan, which was narrower than the loss of 3.832 billion yuan in 2022; After deducting non-profit, the net profit loss is 4.6 billion yuan to 5 billion yuan, and the loss of 4.296 billion yuan in 2022 is still increasing.

According to this caliber, combined with the relevant financial data of Cyrus in the first three quarters of last year, it is not difficult to calculate the approximate range of Cyrus’ fourth quarter revenue and non-net profit deduction.

In the fourth quarter alone, both year-on-year and quarter-on-quarter, Cyrus’ revenue and non-net profit have achieved good growth: year-on-year, revenue increased by 75.9%, and the ratio of loss-making revenue shrank by 29.1%; Under the ring-on-ring caliber, revenue increased by 242.1%, and the ratio of loss revenue decreased by 53.8%.

Source: Car owners’ home

The substantial improvement of Cyrus’ ring caliber is the result of its recent strategy, which can be summarized in one sentence-Do everything you can to increase the sales of the new M7, even if you directly suppress your own lower-end M5, even if you sell one, you will lose one.

The "crazy profit-making" has brought two results. One is the apparent loss of profit: in the fourth quarter of 2023 alone, Cyrus accumulated more than 2 billion yuan on the new M7. If the first quarter of 2024 is added, the total amount of "profit-making" will reach 5 billion yuan. However, as the sales volume of the new M7 began to climb, the production and manufacturing assembly line of Cyrus began to operate efficiently, and its average vehicle cost began to decline.

According to the estimated financial results in the fourth quarter and the historical sales volume of Celestial Group, the new M7 has realized the positive adjustment of non-net profit deducted from cars in the fourth quarter of 2023.

The first two quarters of 2023, and the fourth quarter.The deduction of non-net profit performance is similar; Non-Cyrus brand in two time periodsThe sales figures are also very close.. In other words, during these two periods, the Celeste brand basically realized the zero deduction of non-net profit.

Corresponding to the specific vehicle type, it is the result of selling 7,000 vehicles less than the M5 and 49,000 vehicles more than the M7. It is certainly unrealistic for these two models to "break even" at the same time, which can only be "M5 lost and M7 earned".Combined with the ratio of the number of sales changes, it should be "M7 earns thousands, M5 loses tens of thousands".

Cyrus could have made more and more profits as long as it continued to produce and sell M7, but obviously other car companies did not intend to let Cyrus enjoy the market segment of about 250,000 yuan, 5 seats and 7 seats, giving priority to household use and highlighting the intelligent SUV products.

The ideal came straight to the world of inquiry, and the price of M7 in the world of inquiry has been adjusted, dropping by 20,000 yuan.

Take L6, the first brand-new model with a price below 300,000 yuan, which was released last week as an example, not only aimed at the new M7 in product design and positioning, but also directly set the starting price consistent with that before the new M7. The ideal "name-calling match" left Cyrus no choice but to directly reduce the price of the new M7 by 20,000 yuan in early April this year.

The operation of price reduction has once again "guaranteed" the next sales volume of the new M7, but it will inevitably turn the non-profit "earning thousands" of the M7 bicycle deduction into "losing thousands to more than 10,000" again, and make the break-even point of the new M7 move back again.

Besides M7, M5, which was "strategically abandoned" at the end of last year, is about to return. At the "2024 Beijing Auto Show" held this week, Sailis will re-release "Ask the M5". Judging from the previous information, the new M5 will probably follow the old path that the new M7 has taken. Impact the market through "adjustment of configuration+substantial price reduction". The price is definitely lower than M7, and it is closer to the positioning of mainstream products of many independent car companies, which makes M5 destined to become a difficult challenge again.

Obviously, although the product combination of "M5+M7" still has the ability to bring sufficient sales to Cyrus, it is unlikely to bear the burden of "making profits". If you don’t want to end up making money at a loss, Cyrus must find a new way out.

The listing of the M9 at this critical time not only provided a new outlet for Sailis, but also opened a new stage of China Automobile, which was a "miracle".

M9, why can it be called a "miracle"?

There are two main reasons why M9 is called "miracle":

Let’s talk about the sales figures first. On April 11th, at the Huawei HarmonyOS Spring Eco-communication New Product Launch Conference, Yu Chengdong announced two big figures: the cumulative big figure of M7 was 174,000, and the big figure of M9 exceeded 70,000.

At the end of last year, the propaganda offensives of both Cyrus and Huawei were full, and a large number of publicity was carried out several times.

Although since last year, Huawei has been constantly updating big figures and publishing posters through all channels, it is a bit annoying to encourage more consumers to buy the new M7. However, combined with the big figures, sales trends and insurance volume data published by the new M7, the big data spread by it basically does not have much moisture.

As of March, 2024, the cumulative wholesale sales volume of the new M7 was 164,000 vehicles, and the cumulative insured amount was 152,000 vehicles, which is equivalent to the fact that Cyrus still holds an order of about 10,000 vehicles without production and delivery. This digital trend is also in line with the industry law of "stacking orders as soon as new products are released, and then with the improvement of production capacity, undelivered orders gradually decrease and turn into no delivery cycle".

As for the sales volume of M9, up to now, the official has only released two figures: First, it sold 5,446 units in February.; Second, the delivery volume in March was 6,243 units.. The number that can be found from the public insurance database is that in February and March of this year, the number of insurance coverage of 1324 vehicles and 6429 vehicles was realized by the customer M9, which is basically consistent with the official marketing figures.

Image from: Snowball user "Castle Peak Hermit"

Based on the reliable official fixed figures, we can fit and calculate the fixed growth rate of M9, which can be converted into the monthly sales expectation of M9. The snowball user "Castle Peak Hermit" has calculated that the new M9 will increase by about 393 vehicles/day, which translates to 11,800 vehicles in 30 days.

As the earliest fixed data of a new car, its fixed and subsequent sales will further slow down with the passage of time.It is optimistically estimated that the annual sales volume of M9 will be 80,000 ~ 90,000 vehicles.The neutral forecast is that the annual sales volume of M9 will be 60,000 ~ 70,000 vehicles., pessimistic forecast M9 annual sales of 50000 vehicles..

With reference to its guide price of 469,800 yuan to 569,800 yuan, it is a high probability event that the gross profit space of M9 after scale is close to 30%. According to the median price of 520,000 yuan and the wholesale sales of 60,000 ~ 70,000 vehicles in the whole year, M9 can contribute about 10 billion gross profit for Celeste, which is enough to support its fight in the mainstream market and can also be converted into a solid net profit in the final financial performance.

Miaotou once wrote another deep case in early 2023, "Building a new car force, is it dead?" ",in-depth analysis of the reasons for Wei Lai’s worst development in" Wei Xiaoli "-Weilai’s luxury brands and products have basically not sunk into the third, fourth and fifth tier cities. More than half of the high-end "cakes" that have been paved by many rounds of marketing and branding are "unable to eat".

Especially for the new domestic forces, once the order support in the luxury market is insufficient, it is impossible toIn order to maintain its healthy operation at the sales end with higher gross profit, then the subsequent scale expansion and growth of new forces must "borrow money" from institutions and markets at a much greater cost, and the probability of failure increases sharply.

Most new power brands are younger, more receptive to technology brands, more receptive to green changes, and more complete infrastructure for new energy use in first-tier and new first-tier cities. When the "upstart" high-value consumers in this market area are gradually exhausted, and the new forces want to grow or maintain their own sales, they can only "test" down, and eventually they are forced to enter the mainstream market, but they are caught in a further decline.

And this is also the magic of Cyrus. Last year, the new M7 failed to achieve a luxury brand, and it stopped at this year’s M9, and it was an unprecedented success.

This can be seen from the regional comparison of insurance data of M7 and M9. Compared with M7 in the mainstream market, the proportion of M9 in new first-tier and second-tier cities is almost the same. In the past, the proportion of insurance in the third, fourth and fifth-tier cities, which was the most difficult for independent brands to enter, also exceeded 20%, far exceeding the ideal L9 with a slightly lower price, but with some similarities in product positioning.

Combining all kinds of external information at present, Miaotou judges the success of M9, with a high probability because it has successfully captured the opportunity of the domestic "old money" user group market.

From: soochow securities

According to the 2023 China Private Wealth Report, in 2023, 51% of the high-net-worth individuals in China were over 40 years old. It is an important group of people who consume luxury cars in China, but in the past, they were conservative in the choice of models (basically not considering new energy), and they also cared very much about the brands of car companies (basically only considering BBA).

Compared with the first-and second-tier cities with faster city pace, more hard-working people and more "upstarts" with high net worth, the proportion of "old money" users in the third, fourth and fifth-tier cities is definitely much higher than 51%.In other words, if the luxury models of the high-end models of the new forces can obtain continuous sales support in the third, fourth and fifth tier cities, and the proportion of total sales continues to be high, it can basically be confirmed that they have captured the "old money" market.

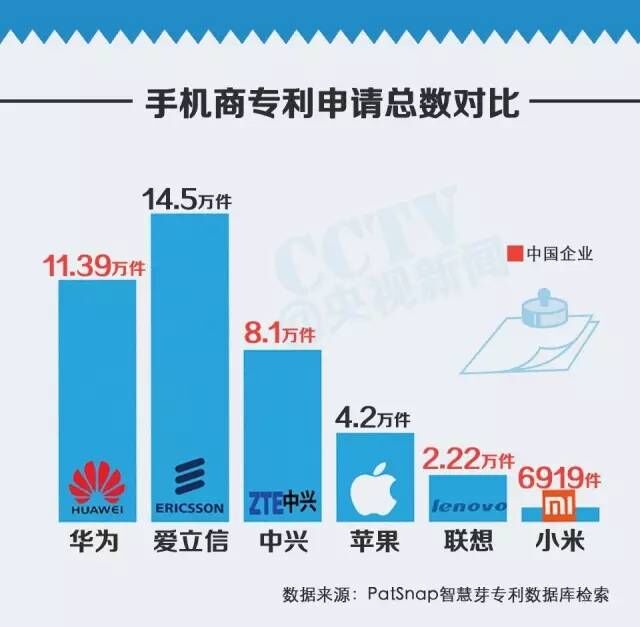

The "sudden" success of M9 in the world is obviously inseparable from Huawei’s brand influence.Thanks to Huawei’s past operation of consumer electronic products such as mobile phones for people over 40 years old, it has established a strong brand influence and technical endorsement, and superimposed on the product side, M9 accurately grasped the demand of successful people for luxury cars, and finally realized the double breakthrough of "region+people".

Finally: talk about performance expectations and industry prospects.

First of all, from the perspective of production capacity, there are currently three factories in Celestial. At the end of last year, the production capacity of No.1 Factory and No.2 Factory has approached saturation (producing new M7), and the total production capacity of these two factories is roughly 30,000 to 35,000 vehicles per month. At present, No.3 Plant is mainly used for M9 production, and its monthly production capacity is close to 7,000, so it is not a big problem to upgrade to over 10,000 units in the next quarter.

Referring to our multiple judgments based on Celestial products, market structure and demand, the goal of the mainstream product "M5+M7" is to run as full as possible.The annual sales target is 300,000 ~ 350,000, the net profit is estimated to be 0 ~ 3%, and the comprehensive break-even point will not appear until at least the end of the third quarter..

The annual sales volume of "M9" is optimistic that the annual sales volume of M9 will be 80,000-90,000, neutral that it will be 60,000-70,000, and pessimistic that it will be around 50,000. The gross profit of a single product is expected to hit more than 25%, and the net profit is not easy to predict at present, so it needs to be calculated in combination with the follow-up sales volume and cost. However, it should be a high probability event that the net profit turns positive during the year.

To sum up, it is a high probability that the performance of Cyrus 2024 will continue to improve, including a substantial increase in revenue and a possible "turnaround" in the fourth quarter. Sellers’ performance with relatively high certainty deserves special attention and layout.

Let’s finally discuss Huawei, because in Miaotou’s view, the impact of the "counterattack" achieved by M9 on the entire automobile industry is more significant than that of Cyrus.

As early as the end of last year, in BYD’s deep case "Huawei is the biggest threat to BYD", we specifically pointed out-Huawei has a tradition of innovation based on user needs and user experience. In cooperation with Huawei, other independent auto companies are expected to pull China’s auto industry into the intelligent stage where BYD is not very good at it.

Obviously, we still underestimated the "help" of Huawei brand in building high-end automobile products.. As a manufacturer that mainly produced minivans and compact passenger cars in the past, Celeste has gradually blossomed in the mainstream market and luxury market, and Huawei’s role is beyond words.

Compared with other new forces "starting from scratch", we can only impress users through one product, and accumulate brand potential energy in a very long period through word of mouth after use; In-depth cooperation with Huawei, directly joining "HarmonyOS Zhixing", enjoying Huawei’s package of intelligent solutions, and finally being able to export through Huawei’s marketing methods and sales network, will probably become an opportunity for many "lost car companies" to reverse their entry into the luxury market.

At the upcoming Beijing Auto Show this week, the brand-new luxury car enjoyment S9 jointly built by Huawei and BAIC is about to usher in its debut; Last week, it was also reported that Huawei executives visited Guangzhou Automobile Group, and the two sides will officially announce cooperation during the Beijing Auto Show.

If Huawei can continue its impact on the luxury market monopolized by domestic joint ventures with the sample of M9, this new energy market, which was first educated by new forces such as Tesla and Wei Xiaoli, may eventually be picked by Huawei.

In the long run, if other car companies want to "immunize" Huawei’s attacks, there are only two ways to go, or their own scale is strong enough, and they have enough R&D and innovation capabilities and funds to keep up with innovation; Either join Huawei’s system, and eventually, with the help of more and more car companies, Huawei’s "snowball" will be rolled into the new energy "Bosch" it aims at, or it will become the new "soul" of China’s auto industry.

Whether auto companies like it or not, Huawei’s increasingly in-depth "spoiler" is pushing the new energy reform of China auto industry to a new level.