Country garden sudden announcement

On the evening of March 28th, Country Garden issued an announcement on the Hong Kong Stock Exchange, delaying the publication of 2023 annual results, and the board meeting will also be postponed. In addition, the company will suspend trading on the Stock Exchange from 9: 00 on April 2.

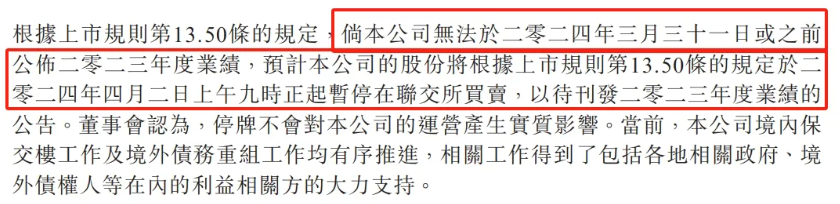

Screenshot from Country Garden’s announcement on the Hong Kong Stock Exchange.

Experts pointed out that since the real estate industry entered the period of deep adjustment, many housing enterprises have encountered liquidity difficulties, and about 40 companies have delayed the release of annual reports. Country Garden delayed the release of its annual performance report, which was expected by the market.

As for the reasons for the delay in publishing the 2023 annual results, Country Garden explained in the announcement that due to the continuous fluctuation of the industry, the business environment faced by the company is becoming increasingly complex, and the company needs to collect more information to make appropriate accounting estimates and judgments, so as to reasonably reflect the changes in the industry and the company in the consolidated financial statements for the year ended December 31, 2023.

At the same time, Country Garden’s debt restructuring is still in progress. In view of the large number and wide distribution of the Group’s projects and the heavy workload and complexity involved in relevant due diligence, more time is needed to collect relevant financial information to carefully evaluate the Group’s current and future financial resources and financial obligations. Country Garden is expected to take longer to complete the preparation of consolidated financial statements as of December 31, 2023, and may not be able to comply with the relevant provisions of the listing rules and publish its 2023 annual results before March 31, 2024.

Country Garden said in the announcement that the Group is working with financial advisers and legal advisers to assess the Group’s situation, and working closely with various creditors to formulate practical measures as soon as possible. In addition, the Board of Directors of Country Garden Group and the management of the company are committed to continuing to actively negotiate with creditors about debt restructuring, and will continue to work closely with the auditor PricewaterhouseCoopers to announce the 2023 annual results and send the 2023 annual report as soon as possible.

According to the listing rules of the Hong Kong Stock Exchange, if the company fails to announce its 2023 annual results before March 31, 2024, the trading of the company’s shares on the Stock Exchange will be suspended from 9: 00 am on April 2, 2024 according to the provisions of Rule 13.50 of the Listing Rules.

The Board of Directors of Country Garden Group believes that the suspension of trading will not have a substantial impact on the company’s operations.

Screenshot from Country Garden’s announcement on the Hong Kong Stock Exchange.

The announcement also revealed the recent situation of Country Garden’s guarantee delivery and debt conversion.

In 2023, Country Garden and its joint ventures and associated companies delivered more than 600,000 houses, with a total delivery area of 71.62 million square meters, covering 249 cities in 31 provinces.

Continue to promote Baojiaolou

According to Country Garden, at present, the company’s domestic security building work and overseas debt restructuring work have been promoted in an orderly manner, and related work has received strong support from stakeholders including relevant local governments and overseas creditors.

As of March 15th, 272 projects under Country Garden have been included in the "white list", distributed in 25 provinces (autonomous regions and municipalities directly under the Central Government), and the amount of financing support has reached 1.732 billion yuan. Other projects that have entered the "white list" are being put in place one after another. Among them, on March 15th, the first batch of "white list" project of Guangzhou real estate coordination mechanism, Country Garden Guangzhou Nanpu Village Project, successfully won the first batch of 50 million yuan loan support from Minsheng Bank, and it is estimated that the annual loan will be 400 million yuan to 450 million yuan.

People close to the company said that the number of short-listed "white list" projects in Country Garden has increased significantly, and the existing projects have been approved by banks, indicating that the efforts of enterprises to actively save themselves and go all out to ensure delivery in the current market environment have been supported and recognized by the government and financial institutions. The "white list" policy of national real estate financing has achieved remarkable results, which is helpful to promote the guaranteed delivery of enterprises.

As of the close of March 28th, Country Garden reported HK$ 0.485 per share, an increase of 1.04%.

News link

Country Garden’s over 10 billion shares were frozen.

On March 25th, Tianyancha information showed that recently, Country Garden Real Estate Group Co., Ltd., a subsidiary of Country Garden Holdings, added several pieces of information about stock right freezing. The enterprises whose shares were executed included Guangzhou Yuedong Country Garden Investment Co., Ltd., Shenzhen paladin Phase V Equity Investment Partnership (Limited Partnership), Shenzhen Huixin No.22 Investment Consulting Partnership (Limited Partnership), Shenzhen Biji Industrial Development Co., Ltd., etc. The amount of frozen shares ranged from 39 million yuan to 6.705 billion yuan, and the total frozen shares exceeded 10 billion yuan. The enforcement courts were the Intermediate People’s Court of Jining City, Shandong Province and the People’s Court of Linyi Economic and Technological Development Zone, Shandong Province.

According to the data, Country Garden Real Estate Group Co., Ltd. was established in April 2015, and its legal representative is Jian Wentang, with a registered capital of about 15.3 billion yuan. It is jointly held by Foshan Shunde Zhouhua Investment Consulting Co., Ltd. and Shenzhen Bigui Technology Development Co., Ltd. Risk information shows that the shares of several companies held by the company have been frozen before. In addition, the company also has information such as the executor and the consumption restriction order.

In response, Country Garden responded that the equity freeze involved cooperation projects of regional companies. Due to the dispute between Country Garden and the partner in cost calculation and pre-distribution of profits, the partner applied to the court for property preservation. Such disputes are normal commercial disputes, and the court has not yet made a final judgment. The frozen equity value is not the same as the disputed object, and the company is ready to raise an objection to the excessive preservation of the partner.

■ Integrated from Country Garden Announcement

■ Editor: Yue Yue, Zhang Ayi